ビジネスワイヤ(バフェットのBerkshire Hathaway group)

パリサー・キャピタル、京成電鉄の第 181 回定時株主総会に株主… 2024年04月24日 10時30分

ロンドン--(BUSINESS WIRE)--(ビジネスワイヤ) --京成電鉄株式会社(9009 JT)(以下「京成」)の第8位株主であり、同社普通株式を1.6%保有するパリサー・キャピタル(以下「パリサー」「当社」、本社:英ロンドン)は、本日、同社第 181 回定時株主総会に資本配分計画に焦点を当てた株主提案(以下、「本株主提案」)を提出しました。

京成が持つ本源的価値と市場評価には、大きな差異、あるいはバリュー・ギャップが継続的に存在し、この解消に向けて当社は、京成と約3年にわたり敬意をもって対話を続けてまいりました。昨年、当社は、バリュー・ギャップ解消を目指した3ステップ・プランを提案しました。詳細は、公開資料をご参照ください。

直近の自己株式買いとオリエンタルランド株式会社(以下、「OLC」)株式売却の取り組みは、正しい戦略的方向への転換として画期的な一歩でありながらも、株主の期待に対して十分とは言えず、これまで当社が提案してきた抜本的かつ持続的な変革には至っておりません。当社は、この数週間、京成とさまざまな選択肢について対話を重ねてまりましたが、本日、京成に対して正式な株主提案を行いました。

本株主提案は、勧告的決議であり、当社は取締役会に対して2024年12月31日までに資本配分計画を策定し、公表するように求めるものです:

成長志向の投資戦略とバランスの取れた株主還元の計画

2026 年 3 月 31 日までにOLC株の持分比率が 15% 未満になるよう、取締役会が適切と判断する方法での保有規模を更に削減するための計画

当社は、株主総会において法的拘束力のない勧告的決議という公正な投票の場を設けることは、個人を中心とする多様な京成株主の皆さまの声を確認することに繋がり、さらに、京成が有する真の価値を解き放ち、成長に向けて歩みだす必要な変化をもたらす最良の方法であると確信しています。

また、本決議は東京証券取引所や日本政府の政策テーマと一致する、よりオープンかつ透明性の高いガバナンスの好事例として評価を得られることにも繋がるものと強く信じております

当社は、京成の取締役会宛の公開書簡において、本株主の提案の背景、目標、およびメリットについて詳細に説明しました。その上で、当社の提案が、京成の来る株主総会の議案として含まれるように取締役会の確認を求めており、2024年4月26日の午後6時までに取締役会からの回答を要請しています。

Palliser Capitalについて

パリサー・キャピタルはロンドンを拠点とするグローバル・マルチ・ストラテジー・ファンドです。当社はバリュー志向の投資哲学を有し、幅広い資本構成の投資を手掛けています。当社は特に、企業及びその様々なステークホルダーとの建設的かつ相手を尊重する長期的なエンゲージメントによって、企業のポジティブな変化および企業価値向上を実現可能な投資機会に注力しています。パリサー・キャピタルは京成電鉄株式会社の第8位株主であり、同社の発行済み株式1.6%を保有しています。

Contacts

メディア問い合わせ先:

株式会社KRIK(広報代理)

越田:070-8793-3990

杉山:070-8793-3989

SMART Modular Technologies、高性能サーバーメモリ拡張用の 新… 2024年04月23日 18時00分

SMARTのCXLアドインカードを使用すると、データセンター、クラウドサービス、HPCプロバイダーは、メモリを大量に使用するコンピューティングアプリケーションのメモリ容量を簡単かつコスト効率よく拡張できます

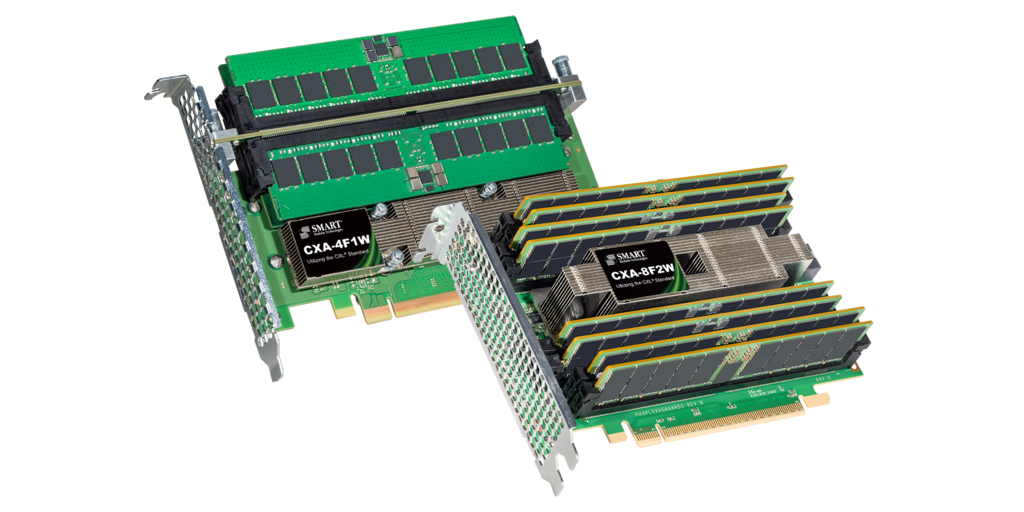

台灣新北市--(BUSINESS WIRE)--(ビジネスワイヤ) --SMART Modular Technologies, Inc.(以下「SMART」)は、SGH(Nasdaq:SGH)の一部門であり、メモリソリューション、ソリッドステートドライブ、ハイブリッドストレージ製品の世界的リーダーです。同社は、Compute Express Link(CXL®)標準を実装し、業界標準のDDR5 DIMMもサポートする新しいアドインカード(AIC)製品群を発表しました。これらは、クラスで初めてCXLプロトコルを採用した高密度DIMM AICです。SMART 4-DIMMおよび8-DIMM製品を使用すると、サーバーおよびデータセンターの設計者は、使い慣れた導入しやすいフォームファクターで最大4 TBのメモリを追加することができます。

「データセンター用途向けCXLメモリコンポーネントの市場は、急速に成長すると予想されています。初期生産出荷は2024年後半に予定されており、2026年までに20億ドルの水準を超えると見込まれています。最終的に、サーバー市場におけるCXL接続率は、拡張とプールの両方のユースケースを含めて30%に達することが予想されます。」と、半導体イノベーションと関連市場の情報源であるTechInsightsのDRAMおよびメモリ市場担当副社長であるMike Howardは述べています。

「CXLプロトコルは、業界標準のメモリの細分化と共有を実現するための重要なステップであり、今後数年間でメモリの導入方法が大幅に改善されると考えられます。」と、SMARTの先進製品開発担当シニアディレクターであるAndy Millsは、Howardの市場分析と、このCXL関連製品群を開発するSMARTの理論的根拠を強調しています。

SMARTの4-DIMMおよび8-DIMM AICは、高度なCXLコントローラーを使用して構築されており、人工知能(AI)、ハイパフォーマンスコンピューティング(HPC)、機械学習(ML)で発生する計算集約型のワークロードのメモリ帯域幅のボトルネックと容量の制約を解消します。これらの新しいアプリケーションには、現在のサーバーが対応できる量を超えた大量の高速メモリが必要です。従来のDIMMベースのパラレルバスインターフェイスを介してメモリを追加しようとすると、CPUのピン制限により問題が発生するため、業界はピン効率の高いCXLベースのソリューションに注目しています。

技術仕様

SMARTの4-DIMMおよび8-DIMM DDR5 AICについて

タイプ3 PCIe Gen5フルハイト、ハーフレングス(FHHL)PCIeフォームファクターで利用可能である。

4-DIMM AIC(CXA-4F1W)は、512 GB RDIMMを使用する場合に最大2 TBのメモリ容量を備えた4つの DDR5 RDIMMを収容し、8-DIMM AIC(CXA-8F2W)は最大4 TBのメモリ容量を備えた8つのDDR5 RDIMMを収容する。

4-DIMM AICは、1基のx16 CXLポートを実装する1つのCXLコントローラーを使用し、8-DIMM AICは、2つのx8 CXLポートを実装する2つのCXLコントローラーを使用する。両方とも合計帯域幅が64 GB/秒になる。

CXLコントローラーは、「信頼性、可用性、保守性」(RAS)機能と高度な分析をサポートする。

どちらも、インバンドまたはサイドバンド(SMBus)モニタリング機能を搭載した強化されたセキュリティ機能を提供する。

メモリ処理を高速化するために、これらのアドインカードはSMARTのZefr™ ZDIMMs™と互換性がある。

SMARTのAICを使用すると、サーバーはコスト効率の高い64GB RDIMMでCPUあたり最大1TBのメモリを実現できます。また、サプライチェーンのオプションを選択することもできます。そして、市場の状況に応じて、高密度RDIMMを多くの低密度モジュールに置き換えることで、システムメモリのコストを削減できます。

詳細については、SMARTの4-DIMM製品ページと8-DIMM AIC製品ページを参照してください。また、CXL規格を使用するSMARTの他の製品については、CMM/CXL製品群ページを参照してください。SMARTは、ご要望に応じてOEMにサンプルをご提供します。これらの新しいCXLベースのAIC製品は、要求の厳しいメモリデザインインアプリケーションにとって理想的なソリューションとして、SMARTのZDIMM DRAMシリーズに加わります。

*様式化された「S」および「SMART」、「SMART Modular Technologies」、ならびに、「Zefr」と「ZDIMM」は、SMART Modular Technologies, Inc. の商標または登録商標です。」、「Compute Express Link (CXL) 」およびすべてのその他のすべての商標および登録商標はそれぞれの所有者の財産です。

SMART社について

SMART社は、メモリとストレージソリューションを専門分野とする世界的なリーディングカンパニーとして30年以上前に米国カリフォルニア州に設立されました(NASDAQ:SGH)。ハイエンドの産業用、及びエンタープライズクラスの組込みメモリ/ストレージ製品の開発に注力しています。製品及びサー ビスとして、メモリモジュール、SSD、フラッシュ製品、ハイブリッドソリューションなどがあり、標準規格品と堅牢型製品のほか、さまざまな用途にあわせたカスタマイズサービスを提供しています。パソコン、ネットワーク、通信、メモリ/ストレージ記憶装置、モバイル装置、軍事・防衛、航空宇宙及び産業アプリケーションなど、分野は多岐にわたります。SMART社は高度なカスタマイズ製品設計能力を備え、厳格で高信頼性のテストサービス、リアルタイムでの技術支援も行っています。また、世界をリードする大手OEMと緊密に連携し、製品の設計からマーケットリリースまで全過程において、高生産性、高信頼性のソ リューションを提供しており、各種産業用制御システムのニーズに適う製品及びサービスを幅広く供給しています。詳しい情報については www.smartm.com/jpをご覧ください。

Contacts

当社の製品マーケティング窓口

Arthur Sainio

SMART Modular Technologies

Director, DRAM Product Marketing

39870 Eureka Dr., Newark, CA 94583

+1 (510) 364-3647

arthur.sainio@smartm.com

当社のメディア窓口

Morris Yang

SMART Modular Technologies

Marketing Manager

+886 (2) 7705 2770

Morris.yang@smartm.com

クエクテルが東京で開催されるJapan IT Week【春】でIoTソリュ… 2024年04月23日 13時58分

TOKYO--(BUSINESS WIRE)--(ビジネスワイヤ) --Japan IT Week --グローバルなIoTソリューションプロバイダーであるQuectel Wireless Solutions(クエクテル)は、2024年4月24日から26日まで東京で開催予定のJapan IT Week【春】に参加することを発表します。

イベント期間中、クエクテルは、5G、狭域通信、スマート、GNSS、LPWAモジュールを特徴とする革新的なIoTソリューションを、様々な補対アンテナとサービスとともに、幅広くご紹介します。ご来場様にとっては、当社の専門家チームと交流しながら、最新の製品とテクノロジーをご覧になり、潜在的なコラボレーションの機会を開拓いただけるチャンスになります。

加えて、日本をリードするIoT技術プロバイダーの1つとして幅広く認知されているソラコムは先日、IoTデータ通信サービス「SORACOM Air for Cellular」において、次世代SIM技術であるiSIMのサポートを正式に発表しました。その一環として、同社はQuectel BG773A-GLモジュールをSORACOM IoTストアおよびユーザーコンソールで提供する予定です。

ご来場者様には、展示会場でQuectel BG773A-GLモジュールの詳細をご紹介いたします。この革新的な超小型LTE Cat M1、NB1、およびNB2モジュールは、統合SIM(iSIM)サポート機能を備えています。この最先端モジュールのiSIM機能により、柔軟性と簡便性が大きく改善され、インテグレーターやIoTサービスプロバイダーに役立ちます。つまり、単一の在庫管理単位(SKU)番号を持つデバイス1つで、世界中の運用支援に欠かせない、適切な接続にシームレスにアクセスできるようになります。

さらに、クエクテルは、スマートシティ、小売、自動車、ゲームなどの多様な分野で威力を発揮する、当社のIoTモジュールの機能と適応性にフィーチャーしたライブデモンストレーションを実施します。ご参加いただいた皆さんは、当社のブースで以下のデモンストレーションを直接体験できます。

Dynabook が展示するDynabook V83/KW Business 5in1/2in1ノートPCでは、Quectel EM120R-GL LTE Cat 12モジュールを使用して4G WANオプションを作成し、ユーザーに対し、場所を問わない快適なインターネット接続を提供します。

Century Systems は、FutureNet MA-S120/GLAルーターを展示します。クエクテルのEC25-J LTE Cat 4モジュールの使用により、マルチキャリアLTE/3G通信を可能にします。

クエクテルについて

よりスマートな世界を目指すクエクテルの情熱は、IoTイノベーションの加速を後押しします。高度に顧客重視の組織である同社は、優れたサポートとサービスを提供するグローバルなIoTソリューション プロバイダーです。5900人もの専門人員を擁し、成長を続けるグローバル チームは、 セルラー 、 GNSS 、 WiFiおよびBluetooth モジュール、そして アンテナとサービス.

同社は世界各国に事業所を構えてサポート体制を展開しており、その国際的リーダーシップは、IoTの推進と、よりスマートな世界の構築支援のために発揮されています。

詳しくは、 www.quectel.com 、 LinkedIn 、 Facebook 、 X.

本記者発表文の公式バージョンはオリジナル言語版です。翻訳言語版は、読者の便宜を図る目的で提供されたものであり、法的効力を持ちません。翻訳言語版を資料としてご利用になる際には、法的効力を有する唯一のバージョンであるオリジナル言語版と照らし合わせて頂くようお願い致します。

Contacts

Media: media@quectel.com

キオクシア: 小型化および性能向上した、最新世代UFS4.0フラッ… 2024年04月23日 06時56分

モバイル機器のユーザー体験向上に貢献

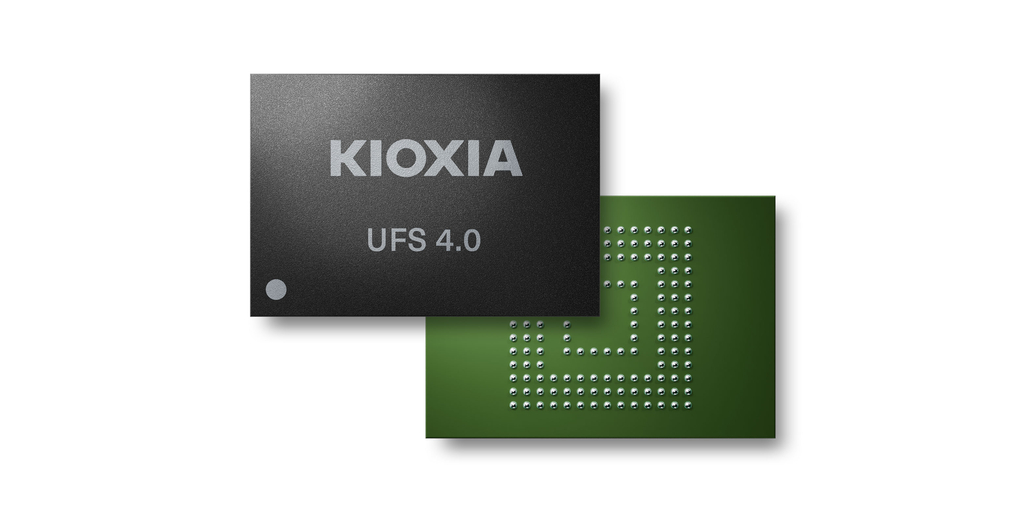

東京--(BUSINESS WIRE)--(ビジネスワイヤ) --キオクシア株式会社は、パッケージサイズを小型化し性能向上した、最新世代のUFS[注1]4.0組み込み式フラッシュメモリ製品のサンプル出荷を開始しました[注2]。新しいUFS4.0対応製品は、当社従来製品比[注3]でパッケージサイズを約18%縮小しており、デバイスの基板スペースの効率化と設計の柔軟性に貢献します。読み書き性能を向上させることにより、データダウンロードの高速化、応答速度の短縮化をもたらし、5G高速ネットワークに対応したハイエンド・スマートフォンを含むさまざまな次世代モバイル機器に適しています。256GB、512GB、1TBの3つの容量をサポートします。

新製品の主な仕様:

当社従来製品に比べて[注4] ライト/リード速度は、シーケンシャルライトが約15%、ランダムライトが約50%、ランダムリードが約30%それぞれ向上しています。

パッケージサイズは9mm x 13mm、パッケージ厚は0.8mm(256GBおよび512GB)および0.9mm(1TB)で、従来のパッケージサイズ(11mm x 13mm)と比較して約18%縮小しています。

最新のUFS4.0対応製品は、キオクシアの3次元フラッシュメモリ「BiCS FLASH™」とコントローラーをJEDEC規格のパッケージに統合しています。UFS 4.0はMIPI M-PHY 5.0とUniPro 2.0に対応し、理論上1レーンあたり最大23.2Gbps、デバイスあたり最大46.4Gbpsのインターフェース速度をサポートします。また、UFS 4.0は、UFS 3.1と下位互換性があります。

関連リンク:

UFS 4.0: 次世代モバイル機器用組み込みストレージ

[注1] UFS (Universal Flash Storage):JEDECが規定する組み込み式フラッシュストレージの標準規格。シリアルインターフェースを採用し、全二重通信を用いているため、ホスト機器との間でのリード・ライトの同時動作が可能。

[注2] 256GB、512GBの製品のサンプル出荷を今月から開始し、1TBの製品については、2024年6月に出荷を開始する予定です。なお、サンプル出荷品は量産時と仕様が異なる場合があります。

[注3] 当社の前世代UFS 4.0対応組み込み式フラッシュメモリの製品との比較。

[注4] 当社の前世代512GBの製品型番「THGJFLT2E46BATP」との比較。

* 本製品の表示は搭載されているフラッシュメモリに基づいており、実際に使用できるメモリ容量ではありません。メモリ容量の一部を管理領域等として使用しているため、使用可能なメモリ容量(ユーザー領域)はそれぞれの製品仕様をご確認ください。(メモリ容量は1GBを1,073,741,824バイトとして計算しています。)

* 1Gbpsを1,000,000,000ビット/秒として計算しています。リードおよびライト性能はキオクシアの試験環境で特定の条件により得られた最良の値であり、ご使用機器での速度を保証するものではありません。リード及びライト性能は使用する機器等の条件により異なります。

* 記載されている社名・商品名・サービス名などは、それぞれ各社が商標として使用している場合があります。

お客様からの製品に関するお問い合わせ先:

メモリ営業推進統括部

Tel: 03-6478-2423

https://business.kioxia.com/ja-jp/buy.html

*本資料に掲載されている情報(製品の価格/仕様、サービスの内容及びお問い合わせ先など)は、発表日現在の情報です。予告なしに変更されることがありますので、あらかじめご了承ください。

Contacts

報道関係の本資料に関するお問い合わせ先:

キオクシア株式会社

営業企画部

進藤智士

Tel: 03-6478-2404

ファラデー、Armと提携してAI駆動の車両ASICを革新 2024年04月23日 06時40分

台湾・新竹--(BUSINESS WIRE)--(ビジネスワイヤ) --ASIC設計サービスとIPソリューションのリーディング・プロバイダーであるファラデー・テクノロジー・コーポレーション(TWSE: 3035)は、最新のArm® Automotive Enhanced(AE)技術を活用し、Cortex® -A720AE IPのライセンス供与により安全性・効率性・品質に重点を置いたAI対応車用ASIC(特定用途向け集積回路)の開発を推進すると発表しました。

2002年以来、ファラデーはグローバルなArmライセンシーであり、現在ではArm Total Designエコシステムの主要なパートナーであることに加え、Armオートモーティブエコシステムの主要なパートナーとなっています。ArmベースSoC設計とサブシステムの統合において20年以上の専門知識を備えているファラデーは、何百もの各種プロジェクトを成功させており、ArmベースSoCのハードニングと性能最適化に精通しています。

さらに、ファラデーには独自のIPポートフォリオだけでなく、IP統合に関する広範な専門知識もあり、SoC設計にサードパーティのIPを迅速に活用することができます。また、成熟したプロセスから最先端のFinFETプロセス・ノードまで、主要ファウンドリー全体に堅牢な設計実装サービスも提供しています。ファラデーは柔軟なビジネスモデルにより、お客様の多様なニーズに対応するオーダーメイドの高水準・高品質ASICチップの提供に取り組んでいます。

「当社がArmオートモーティブエコシステムの一員になれることをうれしく思います」と、ファラデーのCOOであるフラッシュ・リンは述べています。「ISO26262の認定を受け、車載用チップの量産で超低DPPM品質を提供する初のASIC設計サービス・プロバイダーとして、ファラデーは現在、ArmのAE技術を活用することで先進ノードにおける次世代車載用ICの厳しい要件を満たし、顧客の特定ニーズに対応しています」

「自動車業界の重大な変革に対応するには、さらに高度な演算性能と最先端の安全性と効率性のバランスを取る必要があります」と、Armのシニア・バイスプレジデント兼オートモーティブ事業部門ジェネラルマネージャーであるディプティ・ヴァチャーニ氏は述べています。「ファラデーは、Armオートモーティブエコシステムに参加することで、初の車載用高性能Armv9 AクラスCPUであるCortex-A720AEを活用し、ソフトウェア定義型自動車(SDV)の需要に対応することで、イノベーションを推進し続けます」

ファラデーについて

ファラデー・テクノロジー(TWSE:3035)は、取り扱うすべてのICについて、人類に恩恵をもたらし持続可能な価値を支持するという使命に献身的に取り組んでいます。トータル3DICパッケージング、Neoverse CSS設計、FPGA-Go-ASIC、設計実装サービスなど、包括的なASICソリューションを提供しています。当社の幅広いシリコンIPポートフォリオには、I/O、セル・ライブラリ、メモリ・コンパイラ、ARM準拠CPU、LPDDR4/4X、DDR4/3、MIPI D-PHY、V-by-One、USB 3.1/2.0、10/100イーサネット、ギガ・イーサネット、SATA3/2、PCIe Gen4/3、SerDesなど、多様な提供物が含まれます。詳細は www.faraday-tech.com をご覧いただくか、 LinkedIn.

本記者発表文の公式バージョンはオリジナル言語版です。翻訳言語版は、読者の便宜を図る目的で提供されたものであり、法的効力を持ちません。翻訳言語版を資料としてご利用になる際には、法的効力を有する唯一のバージョンであるオリジナル言語版と照らし合わせて頂くようお願い致します。

Contacts

Press:

Faraday Tech, Evan Ke, +886 3 578 7888 ext. 88689, media@faraday-tech.com

XterioがBNBチェーン・AltLayerと共にL2を立ち上げ、Web3ゲーム… 2024年04月22日 17時30分

シンガポール--(BUSINESS WIRE)--(ビジネスワイヤ) --業界トップのWeb3ゲームパブリッシャーであるXterio、そしてBNBチェーンは、ゲームに特化した新しいL2チェーンのための協業を発表いたします。これはBNBをガストークンとして活用し、BNBチェーン・エコシステムのインフラに貢献するものとなります。また、AltLayerが重要な技術的専門知識を提供することで、この取り組みをサポートします。

この協業は、XterioとBNBとの戦略的関係をさらに強化し、BNBエコシステムの途方もなく大きな可能性を活用する扉を開くものです。これにより、XterioとBNBチェーンは共同で、AIによって質が向上し、デジタル所有権で強化された没入型ゲーム・エクスペリエンスを数百万人のBNBユーザーに提供できるようになります。BNBチェーンはさらに、共同キャンペーンやエンドユーザー紹介プログラムを通じて、Xterioに重要なマーケティングサポートを提供します。

XterioはWeb3ゲーム・エコシステムの最前線に立ち、トップクラスの開発スキルと比類のない流通専門知識を提供しています。5つのAAAゲームと45以上のゲームパートナーのネットワークを誇るXterioは、200万人以上のユーザーを持つグローバルなゲーム・コミュニティーを作り上げてきました。業界のベテランであるマイケル・トンとジェレミー・ホーンによって共同設立されたXterioは、Web3技術をゲームに統合し、世界何十億ものゲーマーを魅了することに尽力しています。

XterioチェーンはAltLayerによって運営・管理されます。BNBチェーン上に構築されているレイヤー2として運用され、ロールアップフレームワークとしてOPスタックを利用し、データ・アベイラビリティー(DA)レイヤーとしてアイゲンDAを使用します。このロールアップは、Web3とAI搭載ゲームに焦点を当て、$XTERトークンを活用したAAAゲームを中心としたオンチェーン・エコシステムを構築する計画です。

複数のXterioタイトルに統合されることに加え、XterioチェーンはXterioエコシステムのバックボーンとして機能し、活気あるゲーム・エコシステムへのゲートウェイを提供し、プレイヤーが安全でアクセスしやすい環境でデジタル・アセットを苦労せずに収集・所有・取引できるようにし、開発者が数百万ものアセットをシームレスに作成・配布・管理できるようにします。このチェーンは、包括的なXterio技術プラットフォームと並んで、アカウント抽象化ウォレット、シームレスなオフチェーンおよびオンチェーンのシステム、安価なトランザクション、シングルクリック購入、柔軟な支払いマーケットプレイスおよびローンチパッドなどのおかげで、オンチェーン要素をほとんど見えなくすることを意図しています。XterioマーケットプレイスとNFTローンチパッドは、トランザクションの円滑化に加え、Xterioトークンを多目的な決済手段として採用し、購入とガス料金の両方に利用できるようにすることで、スムーズで便利なユーザー・エクスペリエンスを実現します。

将来的にXterioチェーンは、高度でありながらユーザーフレンドリーなソリューションを求めるゲーム開発者にもその作品に力を与えられるよう門戸を開くつもりです。Xterioチェーンを通じて、開発者はWeb3で最も広範なファーストパーティーゲームカタログにアクセスすることができ、現在急速に成長している200万人以上のユーザーベースを活用することができます。Xterioチェーンは簡単な統合と最先端の機能を約束するとともに、ゲームの未来を牽引する準備を整えています。

BNBチェーンのコア開発チームは次のように述べています。「BNBチェーンと、Web3ゲームおよびAIのリーダーとして知られるXterioとの戦略的コラボレーションは、BNBチェーンのエコシステムを強化し、デジタル所有権を活用した素晴らしいオンチェーン・エクスペリエンスを世界中の何百万人ものユーザーにもたらすでしょう。Xterioの画期的なOPRollUp技術はBNBチェーンに構築されることで最高の卓越性を確立し、毎秒のスケーラブルなトランザクションと、EigenLayerの革新的なリステーキング機能の支援によって強化されたセキュリティーを誇っています。私たちはXterioとそのゲームパートナーとの協力関係を深めることを楽しみにしています」

「XterioはBNBチェーン・エコシステムの中で傑出した地位を築き、世界有数のチェーンおよびプラットフォームとして台頭し、オンチェーンゲームの代表的な存在となるという揺るぎない大望を抱いています」と、XterioのCEOであるマイケル・トンは付け加えました。「世界的に著名で実績のあるチェーンであるBNBとの戦略的パートナーシップは、BNB採用の環境を再定義し、世界中からユーザーを引き付ける活力あふれるエコシステムを育成する態勢を整えています。BNBのパワーを活用し、Xterioのビジョンと専門知識を組み合わせることで、XterioをBNBチェーンの世界における紛れもないリーダーとして確立することを目指します」

業界の有力者がそのオンチェーンゲーム機能を高く評価しているこのバイナンス・ラボ支援のプラットフォームは現在、人工知能(AI)の統合やトークンのローンチなど、ゲームとテクノロジーの機能強化を進めています。

Xterioについて

スイスのXterio Foundationは評議会と、ゲーム開発とパブリッシングの深い経験を持つテクノロジーとエンターテインメントのリーダーからなるチームとによって設立されました。その使命は、高品質のWeb2ゲームおよびWeb3ゲームとインタラクティブ・エンターテインメントを開発、公開、配布することです。

Xterioは、ゲームとAIへのWeb3技術の統合を加速することに力を注いでいます。この取り組みにより、開発者とプレイヤーのエクスペリエンスを簡素化し、分散型ゲームとデジタル所有権の普及を促進します。Xterioは、最新のMACHテクノロジーを搭載した初のゲーム・ロールアップを運営し、ゲームとマーケットプレイスのための最高のローンチパッドの1つです。最近では、オーバーワールド、エイジ・オブ・ディノ、ペルソナのNFT販売に成功しました。

Xterioは$XTERを利用した5つのファーストパーティータイトルを開発しています。各タイトルはジャンルの専門家が主導し、FunPlus、Riot、Tencent、Epicといった有名企業の有能なチームがサポートしています。

詳細については、xter.ioをご覧いただき、@XterioGamesのフォローをお願いします。

BNBチェーンについて

BNBチェーンは、Web3導入の障壁を取り除くコミュニティー主導のブロックチェーン・エコシステムです。以下によって構成されています。

BNBスマートチェーン(BSC):EVM対応L1の中でガス代が最も安い安全なDeFiハブで、エコシステムのガバナンスチェーンとして機能します。

opBNB:L2の中で最も安いガス料金と高速処理を実現するスケーラビリティーL2です。

BNBグリーンフィールド:エコシステムの分散型ストレージのニーズを満たし、ユーザーが独自のデータ・マーケットプレイスを確立できるようにします。

セキュリティーの高いハードルを設定することで、AvengerDAOコミュニティーはBNBチェーンのユーザーを保護し、レッド・アラームがDappsにリアルタイムのリスクスキャナーを提供します。エコシステムはまた、ビルダー・サポート・プログラムの一環として、さまざまな金銭的報酬とエコシステム報酬を提供しています。

詳細については、TwitterでBNB Chainをフォローするか、Dappライブラリーによって探索を開始してください。

AltLayerについて

2021年に設立されたAltLayerは、ロールアップのためのオープンで分散型のプロトコルです。AltLayerは、より優れたセキュリティー、分散化、迅速なファイナリティー、相互運用性で既存のロールアップを補完する「restaked rollups」という斬新な製品で知られています。

そのプロトコルの上に構築されたロールアップ・アズ・ア・サービス(RaaS)ランチャーは、開発者や初心者が2分以内にカスタマイズされたロールアップをスピンアップすることを可能にする手間のかからないプラットフォームです!この製品はマルチチェーンとマルチVMの世界のために設計されています。

これらの製品を組み合わせることで、モジュール式ブロックチェーン・エコシステムの基盤が形成され、あらゆるWeb3アプリケーションのスケーリングを加速できる何十万ものロールアップの拠点となります。また、完全にオープンかつ自由参加型でありながら、資本の大幅な節約、チームの開発期間の短縮、イノベーションの促進、エクスペリメンテーションの迅速な推進に貢献できます。

NFTセクター、Web3ゲーム、DeFi、リアルワールド・アセット・トークナイゼーションなどに及ぶ業界では、アプリケーションのスケーリングにこれらのロールアップを活用しています。AltLayerは、OPスタック、アービトラム・オービット、ポリゴンCDK、ZKスタック、セレスティア、アイゲンDA、アベイル、エスプレッソなど、主要なスタック、代替DAレイヤー、共有シーケンサーをサポートしています。

Alterとなることをご希望なら、私たちのコミュニティーに参加してください。

アップデートのフォロー:https://twitter.com/alt_layer

私たちと関わる:https://discord.gg/altlayer

詳細:https://altlayer.io/

本記者発表文の公式バージョンはオリジナル言語版です。翻訳言語版は、読者の便宜を図る目的で提供されたものであり、法的効力を持ちません。翻訳言語版を資料としてご利用になる際には、法的効力を有する唯一のバージョンであるオリジナル言語版と照らし合わせて頂くようお願い致します。

Contacts

Sibel Sunar

fortyseven communications for Xterio

xterio@fortyseven.com

カネカ生分解性バイオポリマー Green Planet®製の発泡成形品 … 2024年04月22日 13時46分

東京--(BUSINESS WIRE)--(ビジネスワイヤ) --株式会社カネカ(本社:東京都港区、社長:藤井 一彦、以下「カネカ」)のカネカ生分解性バイオポリマー Green Planet®(以下、Green Planet)を使用した「Green Planet発泡成形品」が、ソニー株式会社(本社:東京都港区、以下「ソニー」)の大型テレビ用の緩衝材として採用されました。今夏から発売される85インチのブラビア®に使用されます*1。大型で重量のあるテレビの輸送時の耐衝撃性を確保するには、特有の強度や耐久性が必要とされます。ソニーの包装設計の技術的な知見とカネカの材料成型技術を用いて、両社で技術的な検証を重ねることでGreen Planet製の発泡成形品を緩衝材に用いることを実現しました。家電製品の緩衝材にGreen Planet発泡成形品を用いる事例は世界初*2となります。

Green Planetは、石油資源に依存せず、環境にやさしいソリューションを提供したいという思いを原点に、当社が開発した100%バイオマス由来の生分解性バイオポリマーです。幅広い環境下で優れた生分解性を有し、土壌中に加え海水中でも容易に分解されCO2と水に戻るため、プラスチックによる環境汚染問題の解決に貢献します。今回のGreen Planet発泡成形品は、当社が長年培ってきた発泡成形の技術とGreen Planetの開発技術を組み合わせて生みだした製品であり、今後は家電の包装材、生鮮食品の輸送容器や漁業資材といった幅広い緩衝材用途に展開してまいります。

当社は「カネカは世界を健康にする。KANEKA thinks “Wellness First”.」という考えのもと、ソリューションプロバイダーとしてグローバルに価値を提供しています。今後も、Green Planetの普及を通じてサステナブルな社会の実現を目指してまいります。

|

|

| |

|

|

Contacts

株式会社カネカ

IR・広報(Investors & Public Relations)部

原田 千佳

Info_PRoffice@kaneka.co.jp

AIメディカルサービス、タイ・Mahidol大学と共同研究契約を締結 2024年04月22日 12時00分

〜消化器内視鏡AI分野における日本企業との共同研究として初の事例〜

東京--(BUSINESS WIRE)--(ビジネスワイヤ) --内視鏡の画像診断支援AI(人工知能)を開発する株式会社AIメディカルサービス(本社:東京都豊島区、代表取締役 CEO:多田 智裕、以下「AIM」)とMahidol University(所在地:タイ、999 Phuttamonthon 4 Road, Salaya, Nakhon Pathom 73170 Thailand、以下「Mahidol」)は、このたび2024年3月1日に共同研究契約を締結し、2024年4月1日から内視鏡AIに関する共同研究を開始します。

消化器内視鏡AI分野における日本企業との共同研究契約の締結はAIMが初の事例となります1。

■共同研究の内容と目的

AIMはMahidol大学とタイにおける内視鏡AIの実用性を検証するための共同研究を開始します。

AIMは2023年12月に日本において内視鏡検査中に肉眼的特徴から生検等追加検査を検討すべき病変候補を検出し、医師の診断補助を行うAI搭載の内視鏡画像診断支援システムの製造販売承認を取得し2024年3月から販売を開始しています。また、2024年2月にはシンガポールにおいて胃病変の腫瘍性・非腫瘍性を判定する内視鏡画像診断支援システムの医療機器登録を完了しました。

AIMは、日本のみならず世界の臨床現場に当社製品を展開することを目指しており、日本の症例データを用いて開発したAIモデルがタイにおいて有効に活用できるか本研究を通じて検証します。

なお、このたび共同研究を実施するMahidolは1888年に設立されたタイで最も権威ある大学のひとつで、医学分野をはじめとして、科学、獣医学、工学、人文学など幅広い分野で教育研究を行うタイの最高峰の総合国立大学です。

AIMは、Mahidolとの共同研究を通じてタイの臨床現場における内視鏡AI活用の可能性を探ります。

■代表取締役CEO多田智裕のコメント

タイを代表する大学のひとつであるMahidol Universityとの胃がん内視鏡AIの共同研究を開始できることを大変嬉しく思っております。

アジア圏において、胃がんの罹患者数・死亡者数の多さと早期の段階でのがん発見は対策するべき深刻な課題であり、タイの臨床現場においても内視鏡による胃がんの早期発見と早期治療が求められています。AIメディカルサービスは、日本が世界をリードする内視鏡医療の知見や実績の結晶である内視鏡AIを一日も早くタイの臨床現場に届けるために本共同研究に取り組んで参ります。

■Jirawat Swangsri医師のコメント

経歴:

Assistant Prof. Jirawat Swangsri MD.Ph.D.

Division of Minimally Invasive Surgery

Department of Surgery

Siriraj Hospital Mahidol University

コメント原文:

“We are excited to begin collaborating with AIM, the world leader in research and development of endoscopic AI.

As you know esophageal cancer and gastric cancer cases are on the rise. The early detection and early treatment to the upper GI malignant would gain better survival and quality of life. In our country, the diagnostic of these GI cancer at an early stage is difficult for both training and clinical practice. We hope that AIM's technology will be impact on clinical challenges and improve Thailand health care standard in near future.”

コメント訳文:

「私たちは内視鏡AI領域の研究開発における世界トップランナーであるAIMとのコラボレーションがスタートすることにとても興奮しています。

ご存じの通り、食道がんや胃がんは年々増加傾向であり、腫瘍性病変を早期に発見し治療することが、生存率とQOLの向上につながります。しかしながら、タイにおいてはこのような病変を早期に診断することはトレーニングにおいても臨床現場においても難しいのが現状です。私たちはAIMの技術が近い将来、タイの臨床上の課題解決をサポートし、タイの医療水準の向上につながることを期待しています。」

■AIメディカルサービスについて

AIMは「世界の患者を救う~内視鏡AIでがん見逃しゼロへ~」をミッションに掲げる、医療AIスタートアップ企業です。内視鏡医療は日本が最先端であり、質・量ともに世界最高水準のデータが蓄積されております。なかでも、AIMは100施設以上の医療施設と共同研究・製品開発を進めています。当社は内視鏡AIを医療現場にいち早くお届けすることで、がんの見逃しを減らし、世界の患者を救うことを目指しています。

■代表取締役CEO 多田智裕について

多田 智裕(ただ ともひろ)医師 医学博士

【所属・役職】

株式会社AIメディカルサービス 代表取締役CEO

医療法人ただともひろ胃腸科肛門科 理事長

【概略】

1996年東京大学医学部医学科卒業。東京大学医学部附属病院外科研修医として勤務。2005年に東京大学大学院医学系研究科博士課程修了。2006年よりただともひろ胃腸科肛門科を開業。2012年より東京大学医学部腫瘍外科学講座客員講師。2017年株式会社AIメディカルサービスを設立、代表取締役CEOに就任し、現在に至る。

■海外展開に向けたこれまでの取り組み

当社の海外展開に向けたこれまでの取り組みについてはこちらからご確認いただけます。

会社概要 ――――――――――――――――――――――――――――――

会社名 :株式会社AIメディカルサービス

所在地 :〒170-0013 東京都豊島区東池袋1丁目 18-1 Hareza Tower 11F

代表者 :多田智裕

設立 :2017年9月1日

事業 :内視鏡の画像診断支援AI(人工知能)の開発

1 2024年4月時点。自社調べ。

Contacts

■□ お問い合わせや取材、資料ご希望の方は下記までご連絡ください □■

株式会社AIメディカルサービス 広報 谷口

メールアドレス: pr@ai-ms.com TEL:070-3223-8231 FAX:03-6903-1032

インタラクティブ・ブローカーズが日本でC F D取引を開始 2024年04月18日 04時39分

- 米国株とETFのレバレッジ取引が可能に-

コネチカット州グリニッジ--(BUSINESS WIRE)--(ビジネスワイヤ) --インタラクティブ・ブローカーズ(Nasdaq: IBKR)は、米国コネチカット州グリニッチに本社を構え、グローバルに事業展開を行うオンライン・ブローカーです。この度、インタラクティブ・ブローカーズは、インタラクティブ・ブローカーズ証券株式会社(I B証券)を通して米国株のレバレッジ取引が可能なグローバルC F D取引(差金決済取引)の取扱いを開始し、日本のお客様への商品拡充を致しました。

日本のお客様は、現在I B証券を通して、世界の株式、オプション、先物と共に、C F Dにも投資することができます。C F D取引でレバレッジを効かせて米国株・ETFを売買することで、フレキシブルな投資戦略を可能にします。IB証券のCFD取引は透明性が高く、執行手数料及びファイナンスコストが低い取引口座を提供しております。

米国株C F Dの手数料は1株あたりわずか0.0055米ドルから、日本株C F Dは取引額の0.033%から、シンガポール株C F Dは取引額の0.121%から、香港、ヨーロッパ、オーストラリアを含むその他の株C F Dは取引額の0.055%からとなっています。取引量に応じボリュームディスカウントの適用もございます。

I B証券の代表取締役であるダニエル・ケリガンは次のように述べています。「この度、米国株をはじめとする世界の株のC F Dを日本のお客様にご提供できることを嬉しく思います。 今回の商品拡充によって、レバレッジを活用して米国株やETFをお取引していただけるようになりました。また、お客様が投資戦略を強化し、取引の可能性を最大化するためのダイナミックなツールも提供致します。当社の強力な取引テクノロジー、競争力のある価格設定、グローバルな商品ラインナップをご利用いただき、国内外での投資機会を発見していただけると確信しています。」

日本のお客様には以下の新機能をご利用いただけます:

IBKRデスクトップ:WindowsおよびMac対応の次世代デスクトップ取引アプリ。シンプルさを追求しながらもインタラクティブ・ブローカーズの優れた取引ツールを好むお客様のために設計されています。IBKRデスクトップは、インタラクティブ・ブローカーズで革新的な技術や発想によって新たな価値を生み出し、直感的なユーザー体験へと導きます。

米国株取引時間の拡大:インタラクティブ・ブローカーズは、米国株・ETFのオーバーナイト取引をいち早く導入した証券会社であり、現在、米国株・ETFが取引可能となっています。これにより、週5日、ほぼ24時間、米国株・ETFの取引ができるようになりました。日本のお客様は、日本の日中時間に米国株・ETFを取引していただけます。

端株取引:対象の米国、欧州、カナダの株式およびETFの1株以下の取引ができるようになりました。バランスの取れたポートフォリオを構築するためのシンプルな方法の1つとしてご活用いただけます

ウェブサイトの刷新:日本にお住まいのお客様に、取り扱い金融商品、取引プラットフォーム、取引ツール等に関する情報をご確認いただけるようI B証券のウェブサイトが日本語と英語に対応しました。

インタラクティブ・ブローカーズ・グループはブローカー・ディーラーとして47年目を迎え、世界各国の個人投資家および機関投資家に、一つのプラットフォームを通して米国をはじめとする世界の主要マーケットへの取引アクセス、幅広い金融商品を提供しています。

インタラクティブ・ブローカーズの関連会社であるインタラクティブ・ブローカーズ証券株式会社(IB証券)は、日本で約20年にわたり、投資家のファイナンシャルゴール達成に貢献できるよう活動してきました。

インタラクティブ・ブローカーズの継続的な成功の証として、Barron’s(バロンズ)の2023年のベスト・オンライン・ブローカーランキングでは、5つ星レビューで星5つの第1位を獲得し、BrokerChooser(ブローカー・チューザー)のランキングでは、2024年のベスト・オンライン・ブローカーに選抜され、またStockBrokers.com(ストックブローカーズコム)からは、国際取引部門第1位、プラットフォーム・テクノロジー部門第1位、プラットフォームおよびツール部門第1位として表彰されるなど、数々の賞を受賞しました。

詳細については、https://www.interactivebrokers.co.jp/jp/trading/products-cfds.php をご覧ください。

インタラクティブ・ブローカーズ・グループについて

インタラクティブ・ブローカーズ・グループ、関連会社では、一つのプラットフォームから世界中のお客様に対して、24時間、多種通貨にて世界150以上の市場の証券、デリバティブ、外国為替の自動取引執行とカストディ業務のサービスを提供しています。私たちのサービスは、世界の個人投資家、ヘッジファンド、プロップ・ファーム、ファイナンシャル・アドバイザー、投資運用会社、証券会社様などにご利用いただいています。私たちは40年にわたり取引プロセスの自動化、取引ソフトウェアからリスク管理ツールに至るまでを自社開発し、証券業務のオートメーション(自動化)に注力してきました。その結果、お客様の投資ポートフォリオを管理するための独自の洗練されたプラットフォームを提供することができました。私たちは、常にお客様に有利な取引執行、約定価格を考慮し、お客様がリスク管理・ポートフォリオ管理を行うツール改良し、取引を行うためのリサーチ機能を充実させています。また、市場ニーズに合わせ金融商品の拡充を行い、低コスト又は無料でサービス提供することでお客様の投資収益の向上に寄与してきました。その結果、インタラクティブ・ブローカーは、2023年6月9日付のBarron’s(バロンズ)「ベスト・オンライン・ブローカー・レビュー」で、6年連続5つ星中5つで第1位を獲得しました。

Contacts

インタラクティブ・ブローカーズ・グループ メディア担当連絡先:Katherine Ewert, Email: media@ibkr.com

成人向け予防接種プログラムは初期投資の19倍もの社会経済的価… 2024年04月18日 02時01分

成人向け予防接種プログラムはすべての領域における便益を評価した場合、初期投資の19倍もの利益をもたらすという「業界初」の調査結果を発表

本調査結果は、成人向け予防接種プログラムを含む予防第一の考え方を取り入れることにより、医療制度への圧迫を緩和できる可能性があることを強調

世界予防接種週間を前に発表された本レポートにより、成人向け予防接種を評価するためのエビデンスの有無について、国によってかなりの差があることが明らかに

ロンドン--(BUSINESS WIRE)--(ビジネスワイヤ) --今回発表された新たなレポートによると、成人向け予防接種プログラムは、すべての領域における経済的・社会的価値を評価した場合、初期投資の最大19倍のリターンが得られることが明らかになりました。この19倍という数字は、一連のワクチン接種1人当たり4,637米ドルを社会にもたらす価値に相当します。

この調査は、国際製薬団体連合会(IFPMA)(1)が委託した、Office of Health Economics (OHE)による成人向け予防接種プログラムに関する業界初の分析であり、より広範な経済的・社会的影響を調査するため、ワクチンが利用可能な10カ国における4種類の成人用ワクチンを調査対象としています。

インフルエンザ、肺炎球菌感染症、呼吸器合胞体ウイルス(RSウイルス)、帯状疱疹の予防ワクチンに焦点を当て、オーストラリア、ブラジル、フランス、ドイツ、イタリア、日本、ポーランド、南アフリカ、タイ、米国など、医療制度、人口統計、ワクチンスケジュールが異なる国々におけるワクチンプログラムの実施状況を調査しています。

このレポートは、予防接種プログラムが医療制度におけるコスト削減や、より広範な社会経済的価値を通じて、政府の投資に対して大きなリターンをもたらすと結論付けています。病気を予防することで医師や病院を訪れる回数が減り、貴重なリソースを他の目的に割り当てることが可能となります。さらに、生涯を通じて健康で活き活きと働くことで、経済生産性を高めることができるようになります。

また、成人向け予防接種が小児向け予防接種プログラム(2)に釣り合った社会経済的価値をもたらすこともデータにより実証されています。それにもかかわらず、成人の予防接種へのアクセスは世界各地でばらつきが見られ、定期的な予防接種スケジュールへの組み入れも限られています。

本レポートの共著者でOHEの副最高経営責任者を務めるLotte Steuten教授は次のように述べています

「人口の高齢化といった医療制度への圧迫の高まりにより、予防第一の考え方への転換が喫緊の課題となっています。我々のレポートは、予防へのシフトにおいて成人向け予防接種プログラムが重要な役割を果たすという説得力のある事例を提示しています。」

「調査結果では、政府が成人向け予防接種プログラムに投資した場合、その何倍もの恩恵が社会にもたらされることにより、コストが回収されることが示されています。こうした利益は、個人、家族、地域社会へともたらされるものであり、まだしっかりとした予防接種スケジュールを実施していない、あるいは広く展開していない国々に対する明確な行動喚起を行うものになります。」

調査にあたり、研究者はエビデンスを収集するためにワクチンの価値に関する確立されたフレームワークを使用しましたが、多くの要素にわたりデータが不足していることが分かりました。本調査結果は、いくつかの要素について適切な方法による把握ができておらず、これは成人向けワクチンが社会にもたらす価値が過小評価されている可能性が高いことを意味しています。

このレポートは、WHOの世界予防接種週間に先立ち発表されたもので、このようなエビデンスギャップに対処することは予防接種アジェンダ2030の目標を達成するうえで極めて重要です。このアジェンダには、「すべての人々が生涯を通じて推奨される予防接種の恩恵を受ける」ことを確実にするための戦略的優先事項が含まれており、データに基づいた予防接種の実施が求められていることが明記されています。

IFPMAでワクチン政策担当ディレクターを務めるLaetitia Bigger氏は次のようにコメントしています。

「この重要な調査は広い視点を持ち、成人向け予防接種プログラムが、世界中の医療制度と社会に真の利益をもたらしていることを証明するものです。」

「ワクチンは公衆衛生における最も効果的な措置のひとつであり、経済の生産性と社会のレジリエンスを押し上げる強力な原動力にもなり得ます。」

「成人向け予防接種プログラムの恩恵を受けられる人々が確実に予防接種を受けられるようにするためには、こうした恩恵についての理解が広まることが重要となります。」

オランダのフローニンゲン大学の医薬経済学教授で、本レポートの調査方法に関する査読に携わったMaarten Postma氏は、次のようにコメントしています。

「成人向け予防接種の価値を評価することにより、政策立案者は成人向け予防接種に伴う利益と費用についてより明確に把握できるようになります。この包括的な調査レポートでは、4種類の成人用ワクチンを国際的に調査し、その価値を評価するにあたり厳密な方法論のフレームワークを採用しています。」

国際製薬団体連合会(IFPMA)は、革新的な製薬業界を代表する組織であり、国連と公式な関係を持っています。

統計的生命価値(value-of-a-statistical-life)のアプローチを用いると、10の小児向け予防接種プログラムの投資利益率は、2011年から2020年までは51.0、2021年から2030年までは52.2となっています. (Source: https://www.healthaffairs.org/doi/10.1377/hlthaff.2020.00103).

- ENDS -

編集者注記

レポートについて

「成人予防接種プログラムの社会経済的価値」レポートの全文については以下をご覧ください。 https://www.ohe.org/publications/the-socio-economic-value-of-adult-immunisation-programmes/

OHEについて

Office of Health Economics(OHE)は、60年以上にわたって培われた専門知識と、世界で最も長い歴史を持つ独立した医療経済研究機関です。先駆的で革新的な研究、分析、教育を通じて、ヘルスケアの改善に日々取り組んでいます。

健康、ヘルスケア、ライフサイエンスの経済学における世界的なオピニオンリーダーおよび出版社である当機関は、大学、政府、医療制度、製薬業界と提携し、世界的な健康課題への研究・対応に取り組んでいます。

政府公認の独立した研究機関・非営利団体として、当機関の研究の質と独立性に対する国際的な信用はあらゆる活動において最も重要です。OHEは、医療経済、医療政策、医療統計において、独立した先駆的なリソース、研究、分析を提供しています。当機関の研究は、世界的なレベルで医療と医薬品の問題に関する意思決定に役立つ情報を提供しています。

当機関の研究成果はすべて、オンライン上で無料で利用することができます。 www.ohe.org

国際製薬団体連合会(IFPMA)について

国際製薬団体連合会(IFPMA)は、世界中の90以上の革新的な製薬企業と製薬団体を代表する組織です。約300万人の製薬業界の従業員が、グローバルヘルスを向上させる医薬品やワクチンを発見、開発、 提供しています。ジュネーブを拠点とするIFPMAは、国連と公式な関係を持ち、グローバル・ヘルス・コミュニティが世界中の人々の生活を改善できるよう、製薬業界の専門知識を提供しています。詳細はifpma.orgをご覧ください。

本記者発表文の公式バージョンはオリジナル言語版です。翻訳言語版は、読者の便宜を図る目的で提供されたものであり、法的効力を持ちません。翻訳言語版を資料としてご利用になる際には、法的効力を有する唯一のバージョンであるオリジナル言語版と照らし合わせて頂くようお願い致します。

Contacts

問い合わせ

高解像度の写真を含む詳細、またはブリーフィングやインタビューの手配については、以下にお問い合わせください。

Tim Watson

Director of Marketing & Communications,

Office of Health Economics

T: +44 (0)7866 288456

E: twatson@ohe.org